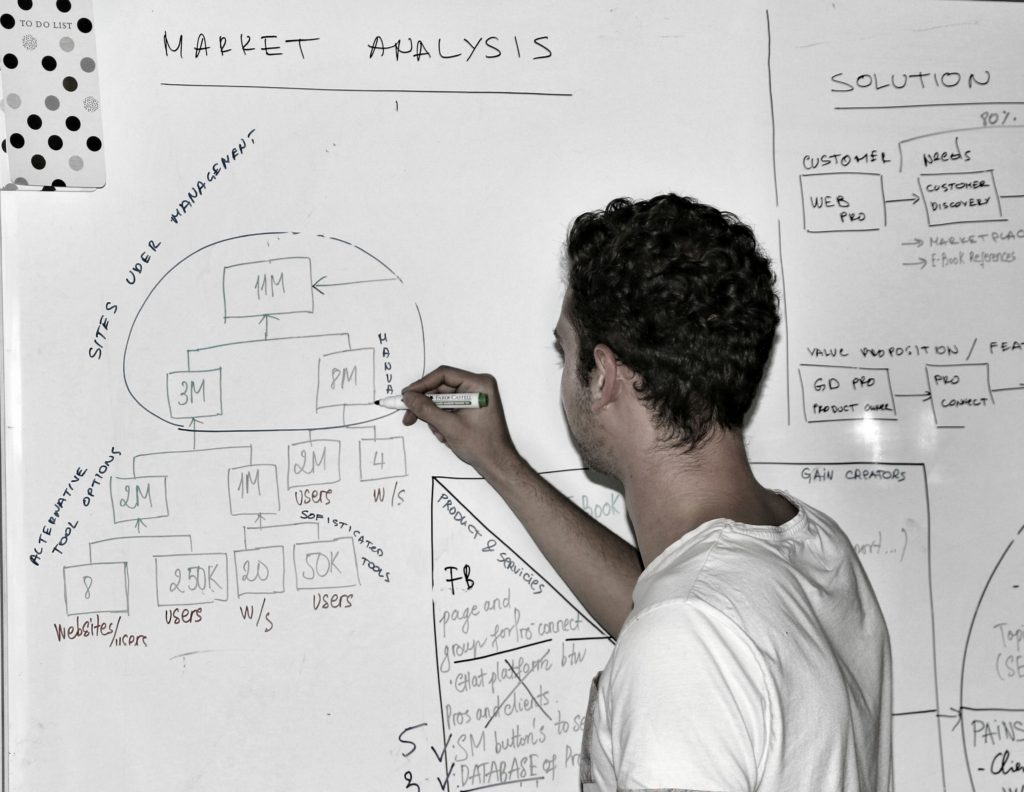

Entering a market with a new product is a tough business. However, it’s your business, and having access to the right information can make a world of difference when it comes to maximizing your product’s chance for success. The first thing you need to do is get an idea of what your potential market size is.

Understanding this can help you pivot as needed, or forge ahead if the forecast looks good. There are a few different ways to approach the process of sizing up your market. We recommend you to try all of them for best results.

In this guide, we will show you three different strategies for measuring your potential market size. By the time we’re done, you’ll understand where to look for accurate numbers, how to crunch that data and the different ways to interpret those results. Let’s talk numbers!

Understanding Potential Market Size

You have a Minimum Viable Product (MVP) and you’re eager to start selling it. However, it might not be a good idea if you doing so before you have an accurate forecast. That’s where your potential market size comes in. It’s an estimate of how many people might want to buy – and can reasonably afford – your product.

To find out this metric, you’ll need to have a clear vision of which type of consumer makes up your target market, what their needs are, and whether those needs are already being met. That gives you the opportunity to refine your Unique Selling Proposition (USP) for that subset of consumers. Furthermore, if you are about to enter the wrong market altogether, this evaluation will help you switch up your approach before it’s too late.

Before jumping in, it’s important to understand that the key word during this process is potential. Think about it as an estimate to steer you in the right direction, rather than cold, hard numbers about how many customers you will find once your product goes live. In fact, many successful innovations were launched into saturated markets or even those that didn’t exist yet. The market might let you down, so you shouldn’t count your eggs before they hatch.

3 Steps for Calculating Your MVP’s Potential Market Size

With the above considerations out of the way, let’s talk about how to calculate your potential market size. There are three accepted ways to do this. It’s best to tackle them step by step to get the big picture.

Step #1: Top-Down Market Sizing

Top-down market sizing refers to the process of taking in the whole market and attempting to infer how big of a slice you can take from it. Essentially, you’re sizing up the entire pie from a distance and looking to figure out if there’s enough space for an extra seat at the table.

Assuming you land a seat, you should get at least a small piece of pie. However, the market – or the pie in this case – isn’t getting any bigger overnight. So you’ll probably be limited to sharing what’s already on the table. The key with top-down market sizing is to find the right numbers to back up your assumptions.

First, you’ll need to find your market’s general data. Places like the Pew Research Center and Forrester can be a good place to start, but you may need to check out specific industry associations if you’re working in a small niche.

Next up, you’ll have to segment the market according to the audiences you’re currently aiming for. This process is usually done using geographic and demographic information. But, other elements like brand loyalty, lifestyles, and price sensitivity can come in handy as well (if you can find the data!).

Finally, pull together your market segmentations and review the numbers. These (potentially overlapping) segments should represent your full market size and with this data in hand,

you can move on to estimating how much of that market is available for you to take over.

This is, of course, hardly the most accurate method to get a clear picture. That is why we recommend that you complement it with the other two steps below.

Step #2: Bottom-Up Market Analysis

The bottom-up market analysis takes the opposite approach to step number one. Rather than estimating a percentage of potential market share, it assumes a specific sales figure. This calls for an accurate evaluation of where products can be sold, how its competitors have fared, and then using those numbers to work out a conservative estimate.

Calculating your potential sales in this way is relatively simple. In the first place, the hardest part is finding the data, which is where we need to get a bit creative.

First, you need to create a list of all the places where similar products to yours are sold. Let’s use a razor manufacturer as a hypothetical example. You can find their product all over the place, but most people would start with local pharmacies. In their case, we would’ve conducted a bottom-up analysis of these kinds of stores by estimating how many of them exist in the USA. IBISWorld suggests there are roughly 77,000 related businesses in the country, and Wikipedia backs up a figure in that same ballpark.

Study the Competition

At this point, the razor manufacturers would have contacted some of these businesses and asked whether they were willing to stock their razors, which would have given them a significant data sample. Let’s say that out of those 77,000 businesses, half said yes. That’s an unrealistic figure by any stretch of the imagination. A big part of those businesses probably belongs to chains, which means that you should count them together. However, in this imaginary scenario, that outreach would be enough to extrapolate a market penetration of 50%.

From there, the razor manufacturer would need to figure out how many razors these stores sell on average, and what their potential customer adoption might be. For example, let’s assume each of the aforementioned stores sells 1,200 razors every year. Assuming each store sells about six brands of razors, they’d probably sell about 200 razors per store every year at most. If we assume that 38,500 stores decided to carry our razors, that gives us an estimate of 7,700,000 sales per year. Not bad at all for an entirely hypothetical scenario, even if the business in question decided to disrupt the market by going the online route.

Of course, the big issue with this evaluation lies in the fact that we’re assuming we’d have an equal market share to established companies right out of the gate. To make sure our assessment holds its own, we need to study the competition.

Step #3: Competition Evaluation

The process of evaluating your competition involves studying the established players in the market to see if and how you can stand out among them. To put it simply, this should be your reality check. This stage should illuminate the dynamics of the market, as well as your potential share of it. That should be enough for you to decide whether to make your move or look for your next project.

Let’s go over what a competitor evaluation should cover. First, you need to make a list of your biggest potential rivals. Then you need to google them and find out as much as you can. You need to find what:

- types of products they offer,

- features they include,

- their level of customer service is like,

- Where they operate, etc.

You should note anything that is remotely relevant to your business.

Once you have this information, you should be able to assess the level of ‘threat’ each competitor poses to your potential business. Are you going to be able to match them when it comes to pricing, features, and customer support? You don’t need to beat your competitors when it comes to every single aspect of your business, but you do need something that will help you stand out.

If you think your MVP has what it takes to gain a foothold in the industry (or you’re willing to pivot to do so), then you may be able to trust your market size evaluations. After all, there’s always room for products that bring a unique value to the market.

Conclusion

Calculating your MVP’s potential market size isn’t the small task. But, it’s a crucial step to help you decide the direction in which you should take your new business. By taking the time to research and review the data, you can maximize your product’s chances of success in the right market.

Before wrapping up, let’s review the three main ways to calculate your MVP’s potential market size:

- Top-down market sizing: Get an inkling of the full picture.

- Bottom-up market analysis: Estimate your potential sales.

- Competition evaluation: Better grasp the mechanics of your market.

Do you have any questions about market sizing and evaluation? Let us know how we can help in the comments section below!

Image credits: Ivana Djujic.