Sometimes it seems as if some UIs are deliberately complicated to use. We wanted to help out a bit and show you, through example, one DeFi strategy and how to leverage credit to make money.

In the fast-paced world of web3 and DeFi, it’s easy to lose focus and move to the next great thing, but we think that DeFi is here to stay.

What is AAVE?

AAVE is a decentralized lending protocol that allows users to lend, borrow and earn interest on their assets. In other words, it allows the users to put their assets to work instead of them. They can just sit around in some wallet doing nothing, all without having a middle man.

Where is AAVE available?

AAVE is one of the pioneers in DeFi. It reiterated versions of the protocol over the years, the newest one being v3 and expanded to multiple blockchains.

Currently, the Ethereum mainnet has the legacy v1 market and the current v2 market. But Ethereum can be expensive for most users because of the gas fees. That’s where Polygon and Avalanche markets come in to make decentralized lending available to everyone.

The current TVL of AAVE is around 12 billion USD by Defi Llama data making it very liquid and stable for usage.

How does AAVE work?

Since, at the moment of writing, there aren’t credit checks or credit scores in DeFi, all loans are provided on an overcollateralized basis. This means that you first have to provide a deposit of larger value than the loan itself to take a loan.

The first question that comes to mind is, why would you take a loan if you already have an amount larger than the loan itself to back it? Why not just sell the assets? By selling the assets, you are closing your position completely and losing potential profit if it goes up. In this case, if some unexpected expense comes in, you can borrow some stable coin, for example, and return the loan while still keeping the base deposit for yourself.

The other use cases could be new investment opportunities like shorting another asset, longing the deposited one, or leveraging some asset for larger APY.

What is Leverage?

Leverage is a strategy of using borrowed funds to increase the potential returns of the original investment. You deposit one type of underlying asset to borrow a different one or even the same one to increase your overall liquidity and ability to earn higher rewards.

How to leverage credit using AAVE?

Supplying assets on AAVE

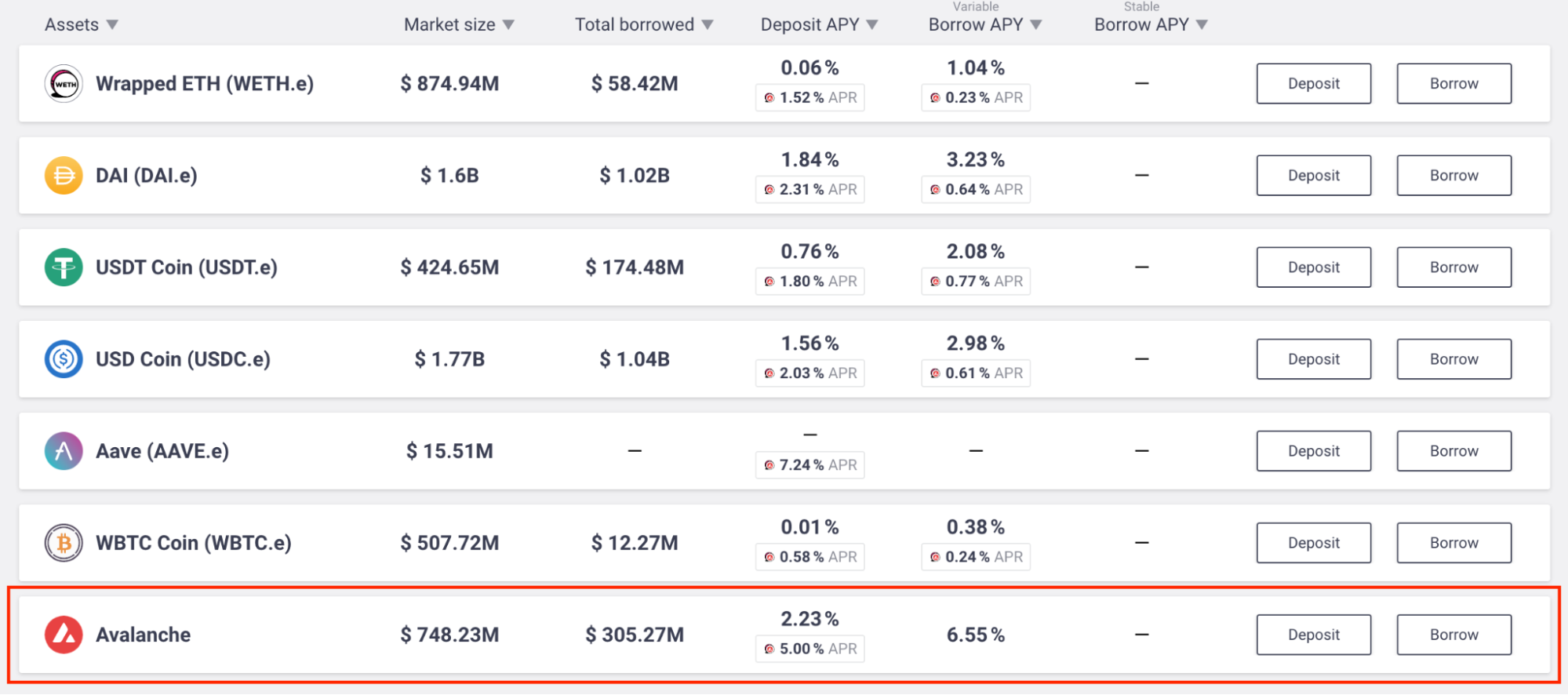

Step 1: Go to the AAVE app and pick your market. For this tutorial, I’ll be using Avalanche.

Step 2: Connect your wallet. You’ll see a big shiny “Connect” button in the top right corner. Once pressed, you can pick the wallet you want to use and you are good to go.

Step 3: Pick the asset you want to deposit from the asset list. I’ll be depositing some Avax.

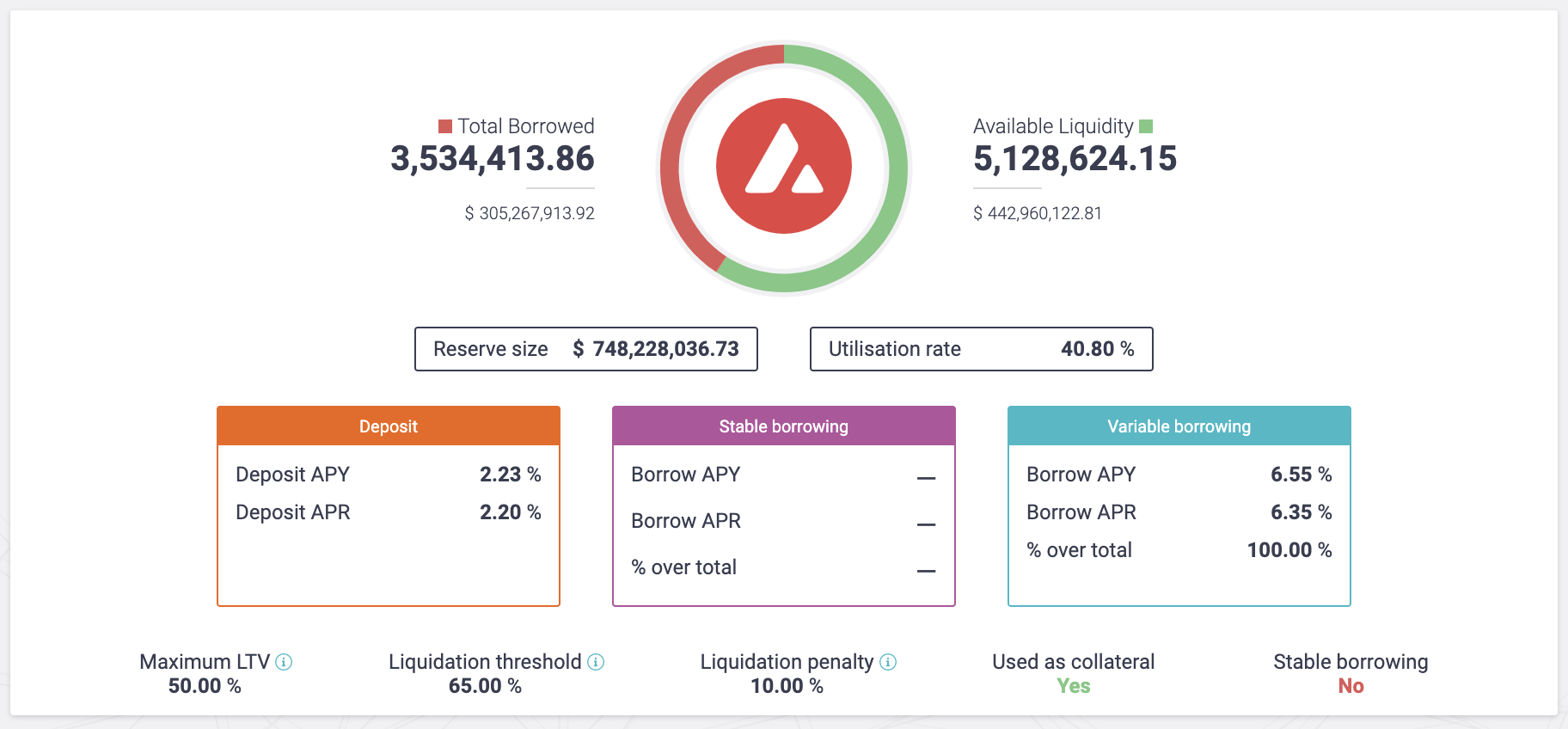

Once you open it, you’ll see all kinds of information, but for now, these four things are important:

- Maximum LTV: This is the maximum loan you’ll be able to take for this asset. For example, for 100$ worth of AVAX, you’ll be able to take a loan of 50$ worth of DAI

- Used as collateral: This is the flag that tells us if we’ll be able to take a loan with AVAX as the collateral. (Important for our leverage strategy)

- Liquidation threshold: This is the point at which our loan will be liquidated if the value of the loan is reached.

- Deposit APY: APY that we’ll be making on our AVAX deposit

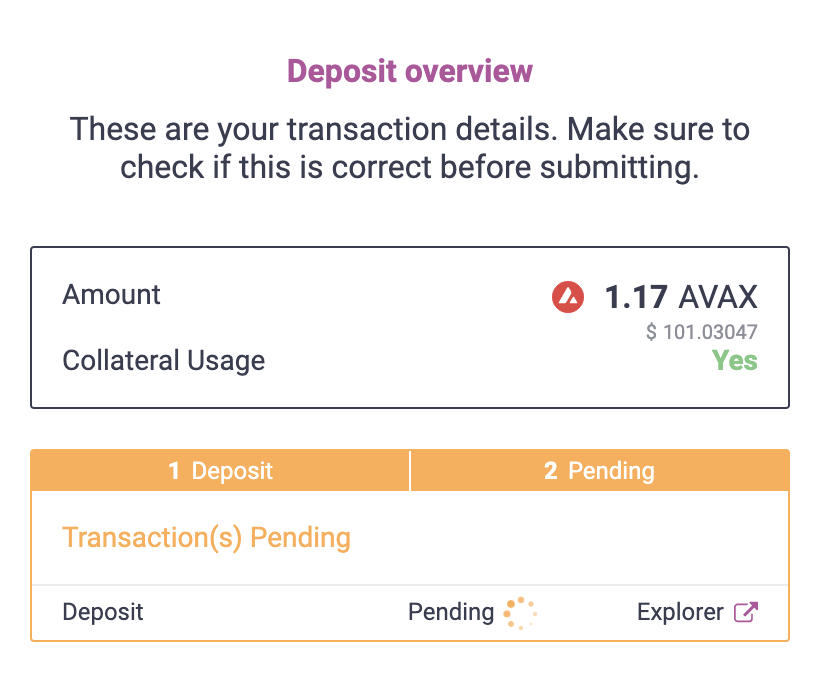

Step 4: Choose the amount you’ll want to deposit, approve the transactions in your wallet and voila, you are all set. I’ll deposit ~100$ equivalent of AVAX.

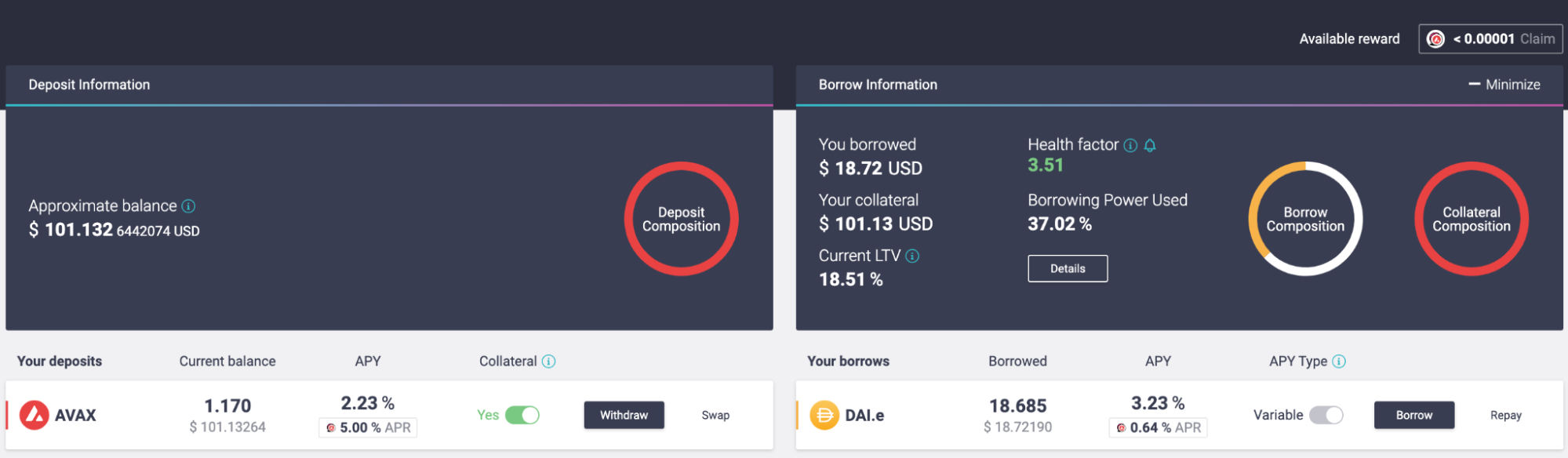

You should now be able to track your position on the app’s dashboard page.

Borrowing assets on AAVE

The fun part is that once we have our assets deposited on AAVE that we can use as collateral, we can borrow something that we deem will make us even more money.

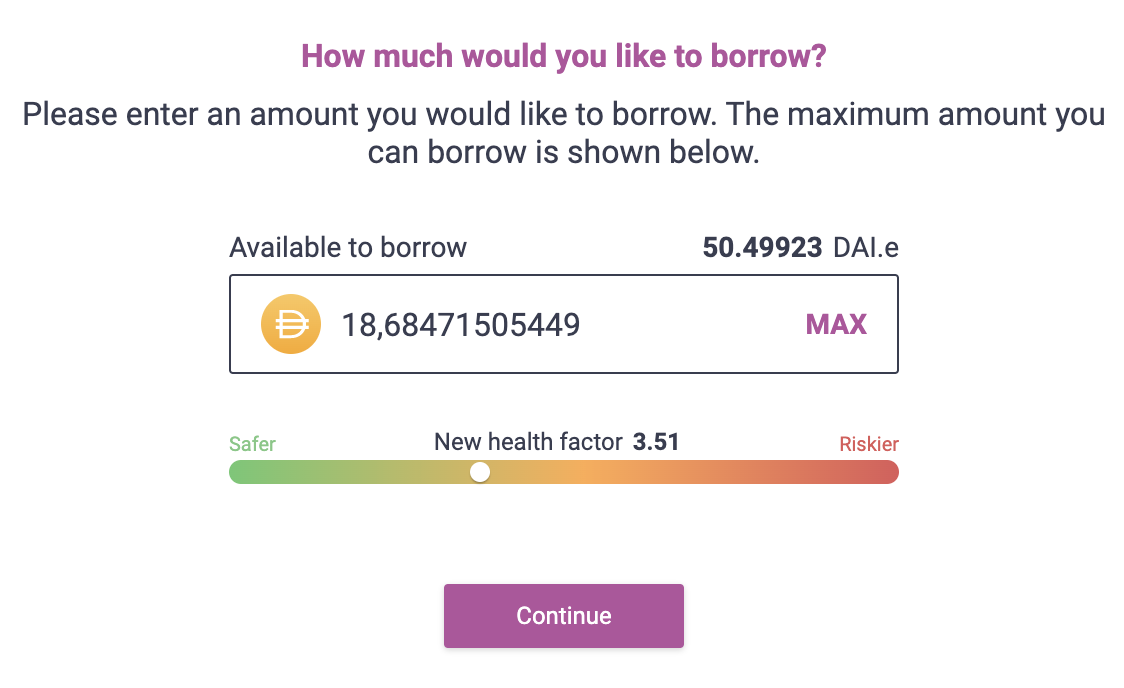

Step 1: Go back to the markets page, and find the asset you want to borrow. On the right side of the page, you’ll find the “borrow” button. Once clicked, you’ll be prompted with input on how much money you want to borrow.

Step 2: Determining how much. Based on the health factor, you can choose to be on the loan’s Safe or the Riskier side. Meaning that it’s more likely for your assets to get liquidated or less likely. For the sake of the example, I’ll go into the safer side of the territory and borrow ~20$.

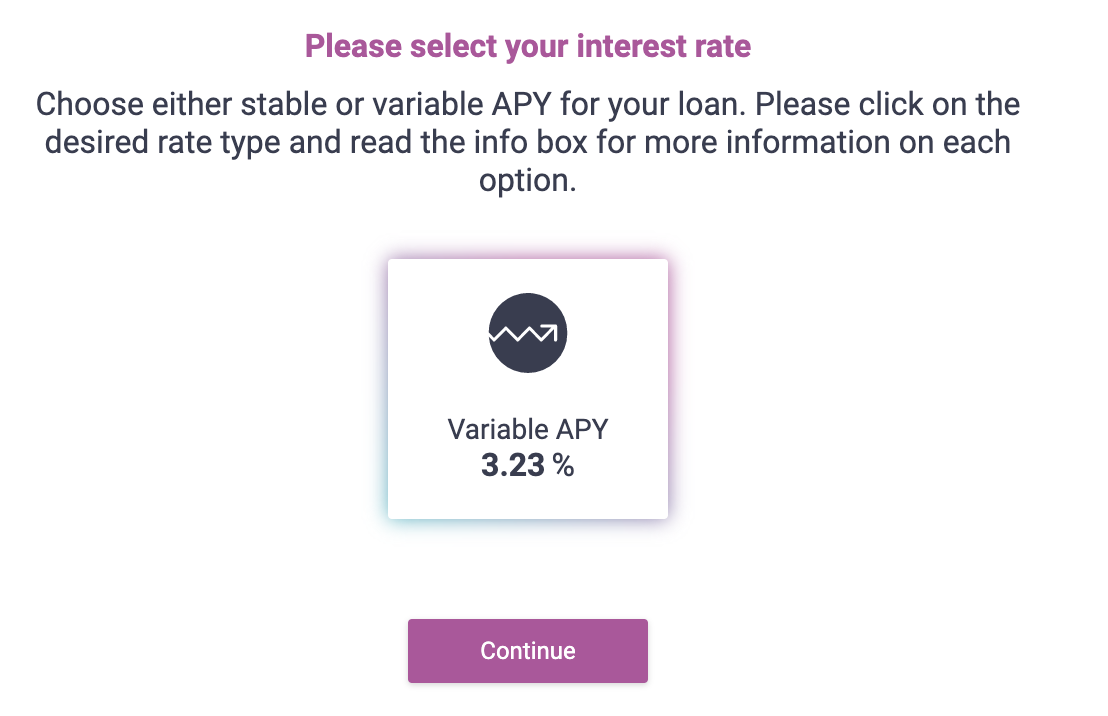

Step 3: Then, we pick the type of interest rate. In this case, only the variable APY is available, wherein there’s also a Stable interest rate. You can consult the difference between these two in the AAVE documentation here.

Step 4: Approve the transaction, wait for it to be mined and now you should have received your dai. To see more information on your position, you can again go to the app dashboard page for a nice overview.

Using newly acquired assets to make more money

We’re almost there! You’ve acquired more funds and determined there’s a good opportunity somewhere to earn interest higher than the borrowed APY and later keep the difference-making the whole hassle worth it.

I won’t be getting into the complete details on how to do this, but I’ll try to give you some general idea on how to make it worthwhile.

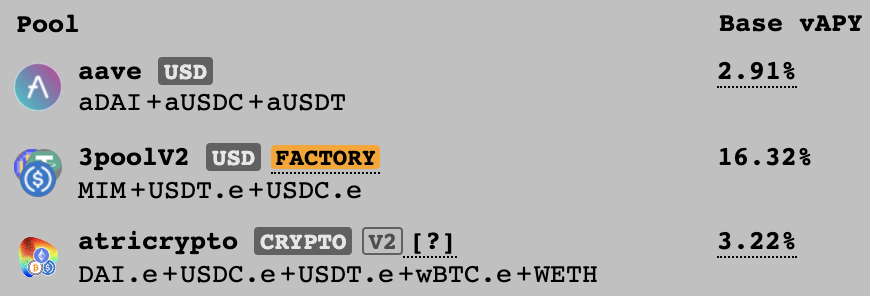

We can now use the newly acquired funds to become a liquidity provider on Curve.fi atricrypto pool with its base APY of 3.22%. Which is enough to pay the borrow rate on AAVE once we decide to return the loan. To be clear, I’m talking about this pool here.

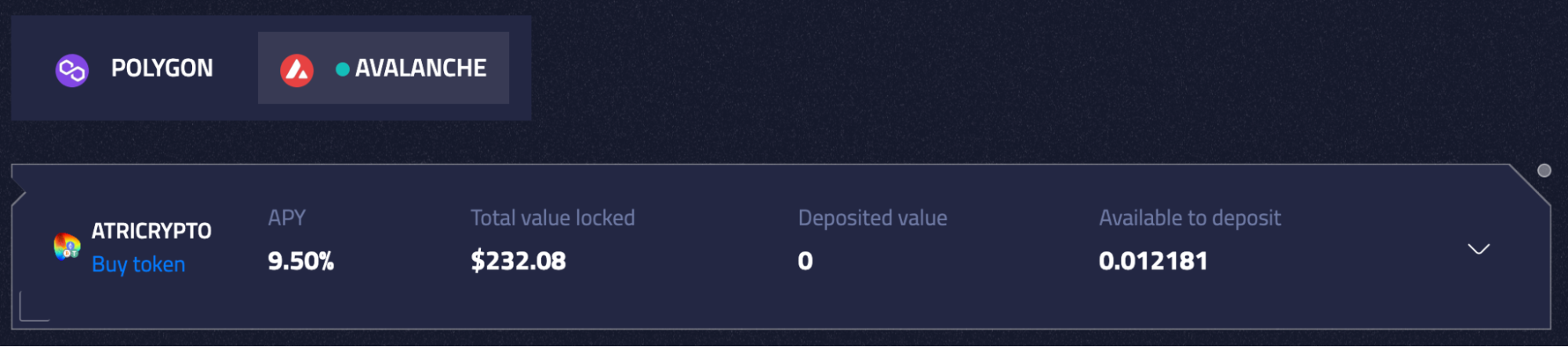

But wait, we still want to make some money. We take a look somewhere else and notice that Tesseract finance provides 9.50% APY for atricrypto LP tokens. Meaning, in the end, we get to keep that APY for ourselves.

The non-attractive part

You’re now a certified DeFi degen. Although you’ll now be making a lot more money than before, having leverage means that you’ll have to actively manage it and ensure your assets don’t get liquidated. This can be tiresome and time-consuming, especially if you’re employing a bit more complex strategies like the one described in part above.

Tesseract finance

If you remember, I mentioned Tesseract as part of the strategy above. Tesseract finance is a yield farming aggregator protocol. In the simplest, most possible terms, a tesseract is an automation tool that does all of the above steps automatically and periodically, so you don’t need to do it manually.

Yield aggregators started as a way to lower the cost of expensive transactions on the Ethereum mainnet. As new chains like Polygon started coming live with significantly lower transaction cost yields, aggregators like Tesseract became an effective tool to avoid manual harvesting, compounding and leveraging, saving people time.

In essence, it allows you to select a specific strategy, deposit your funds into it and have it perform the strategy automatically, growing your principal amount. For more information on how Tesseract started and why check here.

We are looking for a smart contract developer to join our ranks. Someone who will join our team to work on DeFi strategies, the same ones we described above. If you are interested or know anyone who might be a great fit (we have a referral program), please check here.

Resources

For more information regarding Tesseract finance, you can find them here: