Find out why Airdrops have become a common tool for teams seeking to get their platforms to stand out from the crowd.

What is?

Crypto airdrop represents a distribution of free tokens or coins to the crypto community.

Who does that?

Airdrops are usually carried out by blockchain-based startups and already established blockchain-based enterprises.

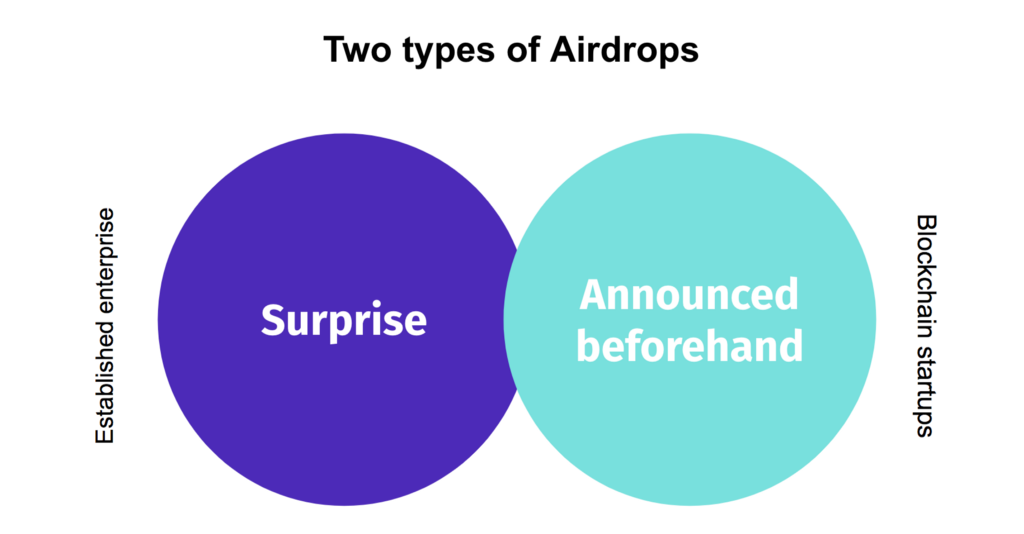

There are two major types of airdrops; the ones that come as a surprise and the ones that are announced beforehand.

The one that comes as a surprise is usually carried out by already established blockchain-based enterprises. They distribute free tokens to their customers and subscribers as a reward for their loyalty. (Binance did that)

On the other hand, since the main goal of blockchain startups is to bootstrap their project, they choose the route that involves pre-airdrop announcements.

Getting involved in crypto airdrop requires:

- Access to information ( this means you have to give up a little bit of privacy providing them with information like: Facebook contacts list..)

- Ownership of a cryptocurrency wallet to receive the free coins (ERC20 wallet since the majority of cryptocurrency tokens in the market are ERC20 tokens. However, if airdrop isn’t token that’s ERC-20 compliant, there’ll be information on how to get the needed wallet.)

- Beside wallet, some companies also required participants to have coins from specified blockchain. ( Ethereum or Bitcoin for example, to prove that your wallet is active).

- Simple social media tasks (Every airdrop has a different set of rules. Currently new airdrops require retweets on Twitter, usually you need a minimum amount of followers. Make sure you have active social media accounts to be eligible for these free crypto tokens. Most airdrops of today require to join their Telegram group so make sure to download the Telegram app. Other possible requirements involve Reddit, Facebook, Medium, Youtube, Slack & Discord, LinkedIn..

One way to stay informed about upcoming airdrops is by signing up for online services that provide these kinds of information. Some of them are:

Tokens as a surprise?

It is possible. Check your wallets regularly to see if you received surprise airdrops. Some platforms have delivered airdrops for their holders without any announcement.

If you are an investor holding a diverse portfolio of coins you are likely to be receiving more and more free crypto as this concept keeps gaining popularity.

Reasons for carrying out an Airdrop

If you’re not paying for the product, you are the product.

1. Creating awareness about a new cryptocurrency

To stand out from the others has never been more complicated and expensive than in the crypto market with new ICOs popping up every day that’s why companies are using Airdrop as useful marketing tool to reach their target customers. People start discovering and talking about “free” tokens, and the word spreads around the community about that particular token. Airdrops create a community/network of people who own the tokens. Beside this, it could also lead to token price appreciation, since people value a token they own higher than a token they don’t own. This is called the endowment effect.

Airdrop actually plants a seed. When you look at CoinMarketCap you will see a list of thousand coins. Just on page one you can see 100 coins listed. However if you have or had a coin that name is still in your brain. The seed is planted and whenever you check CoinMarketCap and scroll down, the name of the free e-Coin will jump out and people will check how it is doing. If they see an article that the free e-Token is doing well or bad, they are more likely to click it if they own it or previously have owned it. So, at least, small part of the community is going to educate itself about your project. It’s just like advertising!

2. Breadth of Distribution

As some statistics show, usually between 30 to 40 thousand people is involved in an ICO. Given that Bitcoin and Ethereum have millions of users, an airdrop is good strategy that will put your tokens in the hands of millions.

3. As a reward for loyal customers

As stated before, blockchain-based services like cryptocurrency exchange and trading platforms, sometimes wish to give back to their customers and subscribers. In that case, they use airdrop to distribute tokens as a way to say “thank you for your loyalty”.

4. To Generate Lead Database

Usually, if you want to be part of an airdrop you will be asked to complete online forms with some information about you. By doing that, companies get valuable user information and can use them to develop targeted marketing strategies in the future.

5. Are free tokens free from regulations?

All regulatory uncertainties about blockchain are based on the question whether the token is utility or security. Since the SEC has found that some tokens can be securities, if a team is considering using an airdrop token distribution they should be aware that even giving away tokens is not necessarily free from regulations. As a result, many token issuers who make their tokens available to U.S. residents seek to structure their token offerings such that they fall within an exemption to the Securities Act — typically, by limiting availability of the tokens to accredited investors. Some token issuers have gone further and have excluded US investors from their token sales altogether in an effort to avoid exposure to the substantial regulatory risk in the U.S.

On the other hand, there are people who are saying that because companies are giving away their tokens for free, people are not making any investment because they are not giving any money, free tokens should be free from regulations.

Although airdrop involve free tokens, it is clear that lack of monetary consideration is not enough to bring airdrop outside the scope of U.S. security laws. So you better be careful.

So once you get them, what do you do with them?

Usually, it takes about 1–2 months after the end of the airdrop before you receive your tokens. This is primarily due to the fact that many airdrops occur before or during token sales, and tokens are not distributable until the end of a token sale anyway.

This also means tokens are not traded yet on the bigger exchanges. But you don’t need to immediately sell your free crypto, there is nothing wrong with being a HODLer.

How to do an Airdrop?

Nowadays is much harder to stand out with all the ICOs that are out there. Instead of ruthlessly promoting themselves all over the internet, project’s creators can take a snapshot of a public blockchain, such as Bitcoin’s or Ethereum’s, and send tokens to all wallet addresses containing some number of Bitcoin or Ether at the time the snapshot was taken. This requires no action on the recipient’s part other than to take whatever steps are needed to take control of the tokens once they have been gifted.

The process can be divided into several stages:

1. Define the aim and airdropping type.

Depending on the stage of the project development and the goals, one must determine what to distribute: free tokens of the main contract, the “bonus tokens” as a reward when buying the basic token, or the token giving a discount for the coins purchase.

2. Blockchain analysis & Identification of the target audience.

For example in the case of OmiseGo, the giant audience of 450 000 addresses was chosen.

3. Smart contract creation and software writing.

If you plan to send tokens on the basis of a basic smart contract, then this possibility should be foreseen in advance.

4. Tokens distribution.

The launch should be smooth and gain momentum gradually, to ensure that it is possible to get feedback and adjust distribution settings.

5. Efficiency track.

One can use Etherscan that shows information about all Ethereum transactions. Besides, there are some classical tools such as Google Analytics. Many questions are received from the tokens receivers on the forums, social networks, channels and groups. If the company finds time to answer most of the questions it will get positive feedback from airdropping.

Does Airdrop have a positive or negative impact on the token’s price?

The main disadvantage that everybody is pointing out when speaking about airdrop is that airdrop has a negative impact on the token’s price. So, I was wondering if that is some kind of a rule, or the actual result vary from project to project. In order to get the answer to this question, I randomly picked 3 projects which did an airdrop. Let’s see what happened to them.

OmiseGo Airdrop

OmiseGo Airdrop was announced retroactively, which means it took place after the closing of the crowdsale.

The OMG airdrop completed successfully and it took 5242 transactions across 36090 blocks to send 7,012,269 OMG to over 460,000 people, worth around $136 million.

Full instructions and details about the code you can find on their GitHub

github.com/omisego/airdrop/

5% of tokens set aside for Airdrop

Every address on the Ethereum blockchain that has a balance over a minimum threshold of 0.1 ETH will receive a share of this 5% that is proportionate to their share of ETH.

For every 1 ETH that you hold, you can receive proportionate 9.7 OMG tokens as an airdrop. Existent OMG holders will also benefit from this airdrop, for every 1 OMG that you already have, you can receive 0.3 OMG.

ICO ended on 23th of July.

Airdrop successfully completed on 24th of September.

So, what happened?

As we can see, in the case of the OmiseGo(one of the most popular Airdrops) token’s price actually remained pretty stable after the Airdrop( given that we are talking about crypto market where nothing is 100% stable). From the chart we can also see that the price exploded from the end of December. Of course, I was interested to see what happened with the OmiseGo project in December. And guess what I found out?

Vitalik’s Buterin tweet in which he supports OmiseGo platform.

Expected or not? In this case we can say that the price is more driven by hype (tweet) than anything else.

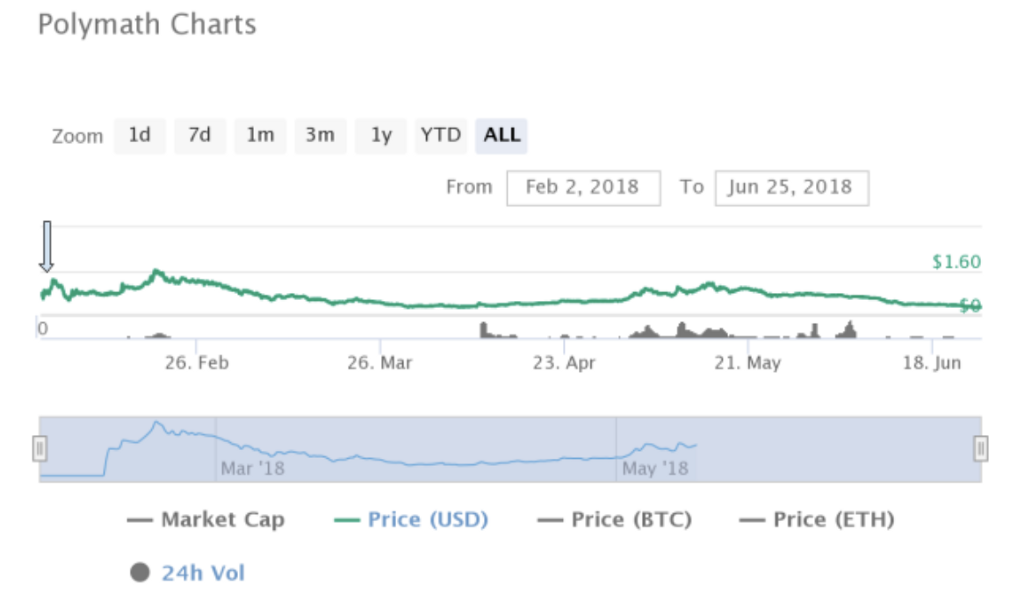

Polymath

They gave away 9,5 million Poly tokens to 38.224 addresses — worth around $12 million.

Airdrop finished 31. 01. 2018.

What is interesting about Polymath is that they planned to have an ICO, but eventually, they decided not to conduct it. They had a private sale in October.

In the case of Polymath the price increased a little bit, and then started decreasing which in numbers means drop from $1.64 in February to $0.32 in April? What happened? Is this the actual effect of the airdrop? A little bit of research and Voila!

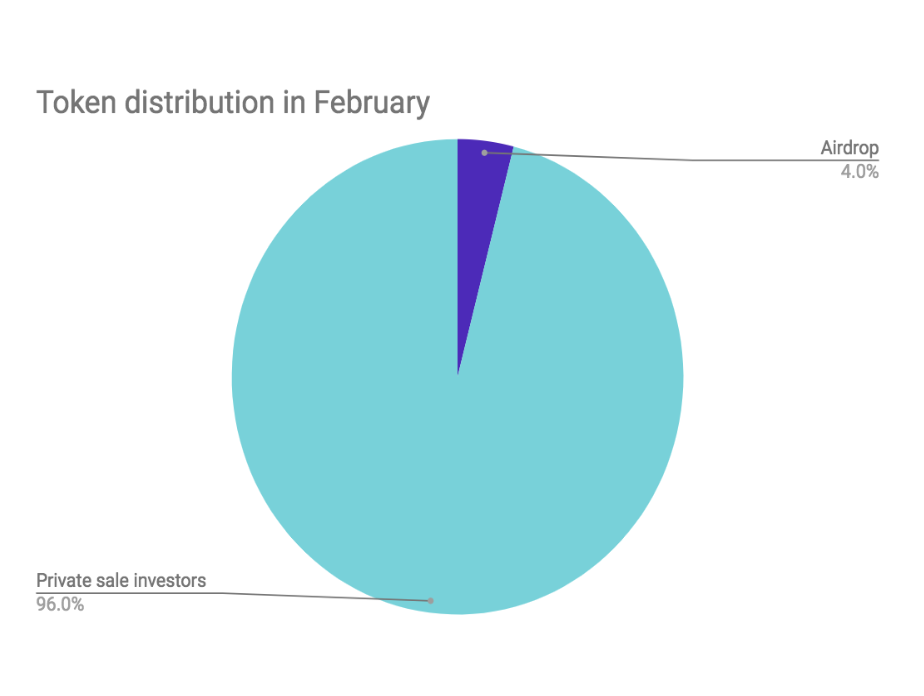

Token distribution in February looked like this. 96% of tokens in hands of private sale investors, and only 4% for the airdrop.

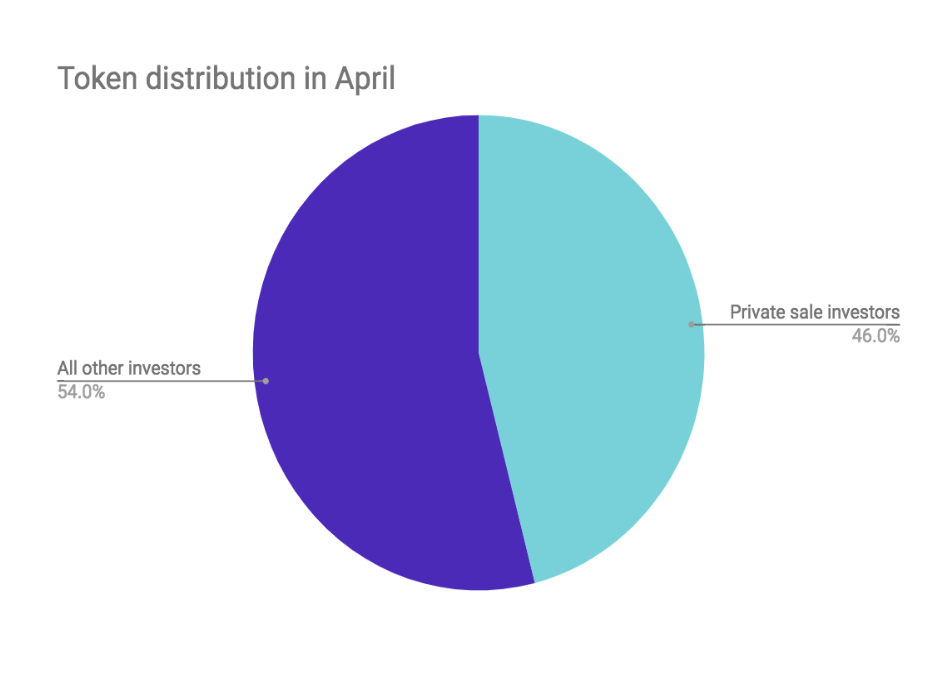

Just one month later, the actual state was like this.

46% in hands of private sale investors, and 54% in hands of all other investors. Token’s price did decrease but once again we can’t say that it is because of airdrop, rather it is because private sale investors started selling their tokens.

It might be interesting to make a difference between two different types of investors: Airdrop “investors” and Private sale investors.

Airdrop investors got tokens for free, and everything above zero is 100% profit for them. With that in mind, when the price is stable they are usually keeping them, when the price increase they are very inclined to hold, and as soon as price goes down, a lot of them are going to sell the tokens and take the profit they had on the table.

Of course, there are people that just believe in project and they are going to keep the tokens.

If we see the number of tokens only 4% of the Circulating Supply were in hands of Airdrop investors. That is, in my opinionm small percent of tokens for some big price fluctuations.

But when we speak about Private sale investors the picture is a little bit different—Usually, when they get their original investment back, they are much more interested in holding tokens and hoping for big wins in the future. Once, the distribution of tokens gets more balanced, there are going to be a mixture of incentives.

Also, the news about Polymath are usually positive, so people are saying that this price decline is definitely a way for incentives to get aligned.

Cashaa

Total token supply 1,000,000,000 CAS

510,000,000 tokens available for the token sale

44,000,000 were sold during private sale

318,000,000 available for the public sale

192,000,000 unsold ICO tokens was distributed to the holders, with a ratio of 70%, meaning that for every CAS token held, holders were rewarded with 0.7 CAS.

Unsold token distribution started the 5th of June. Lets see what happened with price till now.

Since 25th of February Cashaa is officially listed on CoinMarketCap. CoinMarketCap is basically the single most important destination for any altcoin or cryptocurrency company looking to gain exposure for their token/cryptocurrency.

Airdrop of unsold tokens started 5th of June. Since then, as we can see in the chart the price is decreasing. But as this is a very fresh project and it is very hard to say that this price reduction is due to Airdrop.

Conclusion

We have seen 3 different projects and each of them has its own story. In my opinion making any kind of generalizations in the blockchain space can be tricky. Personally for me airdrop and all other strategies that companies are using are just short term strategies. Nobody actually knows what is going to happen with the token’s price in the future.

What I would say after reading a lot about Token’s price is that the price is more driven by these 4 factors.

Tokens utility — If people see real value and utility they are going to keep tokens and become a Holder. But, if they don’t see the potential they are going to sell them as soon as they become available on the exchange.

With Hype and Trust it is obvious.

Market factors — As in any other industry, in the blockchain industry as well companies are affected by different factors that are beyond their control. Various external factors (economic, social, legal, technological and political factors)can impact the ability of a business or investment to achieve its strategic goals and objectives.

All about Airdrops was originally published in MVP Workshop on Medium, where people are continuing the conversation by highlighting and responding to this story.