Target market size research is riddled with chances to ruin all the progress you’ve made so far. If you mess up your research and try to sell to a niche that doesn’t exist, it could mean the end of your Minimum Viable Product (MVP) before you’ve really begun.

Mistakes made while collecting target market data can spoil the accuracy of the results. By learning the common errors made during this stage, you’ll be better equipped to avoid making them yourself. It may take a little extra effort, but you will certainly increase the chances of your MVP’s future success.

Without further ado, we’ll now introduce you to four common mistakes you can avoid while calculating your target market size.

Let’s get started!

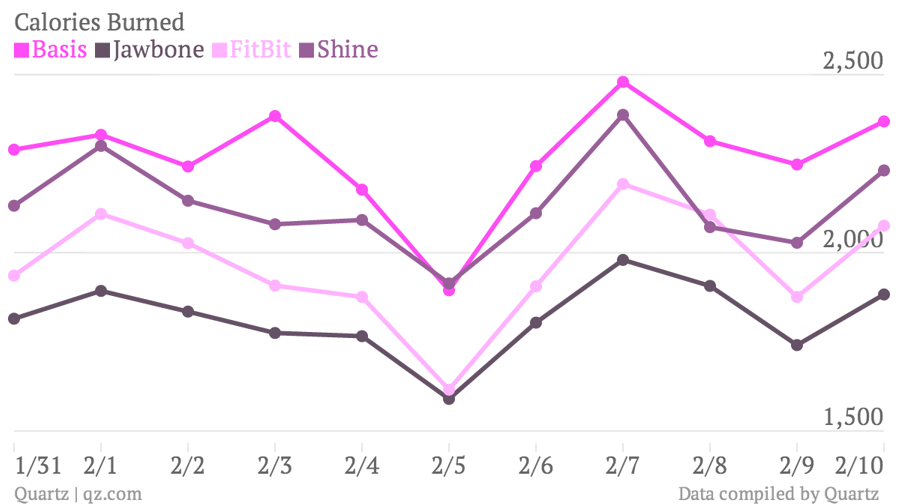

Mistake #1: Using Only One Source for Industry Statistics

We understand that collecting data is hard, unforgiving work. However, don’t be tempted to call it a day after tracking down your first reasonable-looking set of statistics.

No data is infallible, so it’s important that you use multiple sources when researching your MVP’s market size. Sourcing information from more than one place gives you the opportunity to approach your research from different angles. Each new piece of information you collect will help either support or debunk existing research.

For example, let’s say you discover in one study that the average person eats out eight times per month, but further studies conclude that the average is just twice per month. It turns out that in the first study, there was an outlier who ate out multiple times every day and threw off the average. While this is an exaggerated example, used alone, the skewed result of the first study would have given you an unrepresentative view of the market.

As you can see, different sources provide different perspectives, different methods, and a more rounded picture in the end. If you’re not sure where to start, there’s no need to worry. There are many existing data sources to try, such as Think With Google: Marketer’s Almanac, American Fact Finder, County Business Patterns, and Business Dynamic Statistics, to name just a few.

Mistake #2: Asking the Wrong People for Opinions

Say you’ve decided it’s time to carry your own original research, and that you’d like to run a survey. It might be tempting to start with the people already in your network. After all, asking family and friends is far cheaper than shelling out money for a focus group.

Unfortunately, this can quickly lead to skewed results. A phenomenon called personal bias means people who know you will subconsciously try to give you the answers you’re looking for. Therefore, they could well end up giving you a number of false positives and otherwise inaccurate information. As soon as this happens, the resulting data is unreliable.

Thankfully, there are some ways you can work around this. The first solution is to run anonymous surveys. That way your friends are less likely to think about how their name is attached to the information they provide, perhaps resulting in more honest answers. However, this doesn’t completely remove the risk, so you should still be wary of the results.

The second, more preferable solution is to run surveys entirely outside your network. Some ways to gather focus groups include enlisting the help of market size research companies, hiring survey-takers on sites like Craigslist, or advertising on social media. You can be as creative as you want, as long as the people who take the survey aren’t afraid to tell you the brutal truth.

Mistake #3: Soliciting Biased Feedback

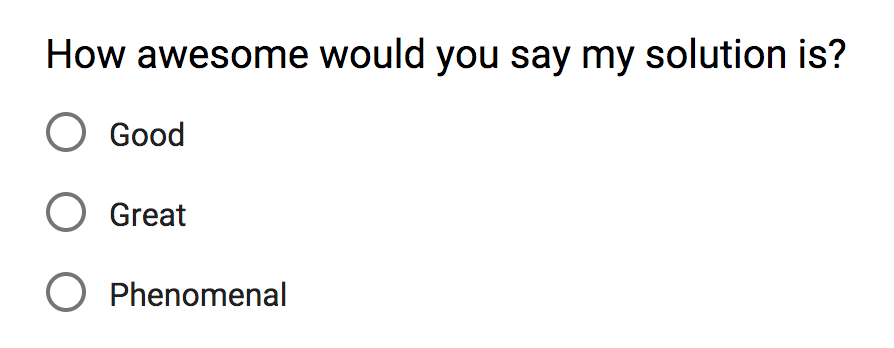

By now you’re ready to run surveys with a group of people who have no reason to make you feel good about yourself. Don’t get too excited yet! There is more bad news about self-made surveys, regardless of who takes them.

This time, the problem might be you. You may accidentally publish a survey that leans towards your own biases.

Whether you’re administering surveys online, over email, or on the phone, even subtle changes can make a big difference in the outcome. For example, your questions may be priming readers to give the response you want. This happens when you use certain words that are more likely to trigger a specific, desirable reaction.

You also need to consider that interviewees may not know how to put their needs or thoughts into words. They are often unaware of the full processes going on in their minds before making a buying decision. For example, they probably don’t notice or remember when background music influences their shopping habits.

One way to avoid these issues, and indeed surveys altogether, is to observe instead of asking. Instead of distributing surveys, find a way to watch your target market. If you have a physical product, you can watch how users interact with it, for example in a store or in focus groups. For a website or digital product, you can run A/B tests and session replays to see when, where, and why people do what they do.

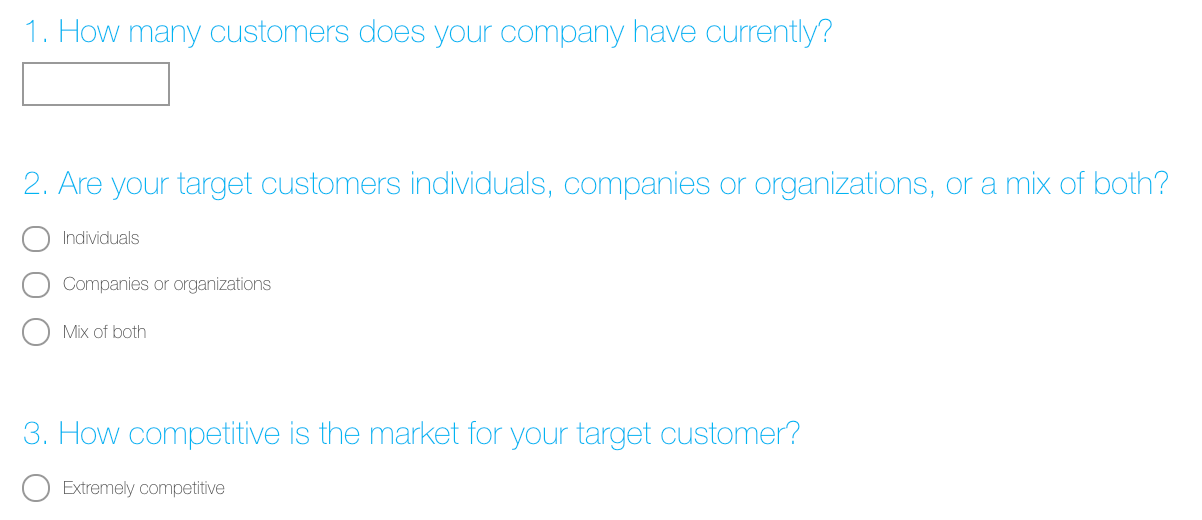

Mistake #4: Exclusively Running Online Surveys

Running online surveys is cheap. A survey and a few paid ads around the web are all you need to attract takers. Sometimes, exclusively running online surveys looks to be the simplest and most inexpensive option. However, while they can be useful, they do come with their downfalls. Moreover, exclusively running online surveys can result in a lack of diversity of results as mentioned in the first mistake above.

If you do run surveys as part of your data collection, avoid biases by crafting objective questions. Then, run them at various scales and in multiple mediums – not just online. For example, you can go large scale by getting hundreds of takers on social media, and then ask a smaller focus group of a dozen hand-selected people. Try it over the phone, in person, via email, and over Skype. Meanwhile, stay cognizant of how the different methods change the results.

Of course, we recommend making sure you have a comprehensive research plan in place that extends beyond surveys. Build out your market size research using a plethora of techniques! A few you can try right now are creating customer personas, researching competitors, and listening to social conversations.

Conclusion

Your target market size research is all a wash if the data is inaccurate, which can lead your MVP down an unsustainable path that results in failure. This is why it is so important to learn from the research mistakes of those who have gone before you.

In this article, we’ve revealed four mistakes that you definitely need to avoid when researching your MVP’s target market size. Let’s recap them quickly:

- Using only one source for industry statistics.

- Asking the wrong people for opinions.

- Soliciting biased feedback.

- Exclusively running online surveys.

What questions do you have about mistakes in MVP target market research? Ask away in the comments section below!

Image credits: Peter Belch, Quartz.