In this article, we will present a simple framework for SaaS pricing model. It is a continuation of our previous post about Saas pricing model. Here you will discover the most important steps that can help you to set up the price of your product/service. This is an essential task. If you don’t do this right, all your work was in vain. Therefore, learn how to place your product on the market with the right price.

SaaS Pricing model – a Simple framework that can change things around

First of all, this article uses data from especially relevant “The Ultimate SaaS Pricing Guide for Seed Stage Companies” published at GrowthHackers. Their SaaS pricing framework will allow you to find the true value of your product. Don’t underestimate this step. Your success in business will probably depend on it a lot.

Say you are finishing a product or a service and you are probably feeling happy with all the work you and your team have done. Impatient to show it to the world? Think you’ve finished everything? It seems like you have specified your price as well. What is a dollar amount of your product? Do you have an answer? If you didn’t, there is yet one more question for you.

Before you set up SaaS pricing model

It’s crucial to understand that the price determination is, most of all, essential for your success. To make things easier, you can use several vital data. The more information you have, the better your price settings will be. Remember, no data point is a single source of truth. You must combine them all.

Take a look at the four keys that open the doors of success:

- Industry benchmark,

- Competitive analysis,

- Economic value analysis,

- Market research.

Starting point – Industry benchmark

First of all, you need to understand the market you are in. If you have competitors, get to know them well. The comparison will give you a far better market picture. What’s the price range that your clients expect to pay? How much can you expect to charge? By the looks of it, the ranges can be quite wide. Therefore, it is crucial to be set in the right place. What will be buyer’s cost depends on many factors. The level of the purchaser reached within the organization. Also, how many users interact with the product. And the breadth of the product offering.

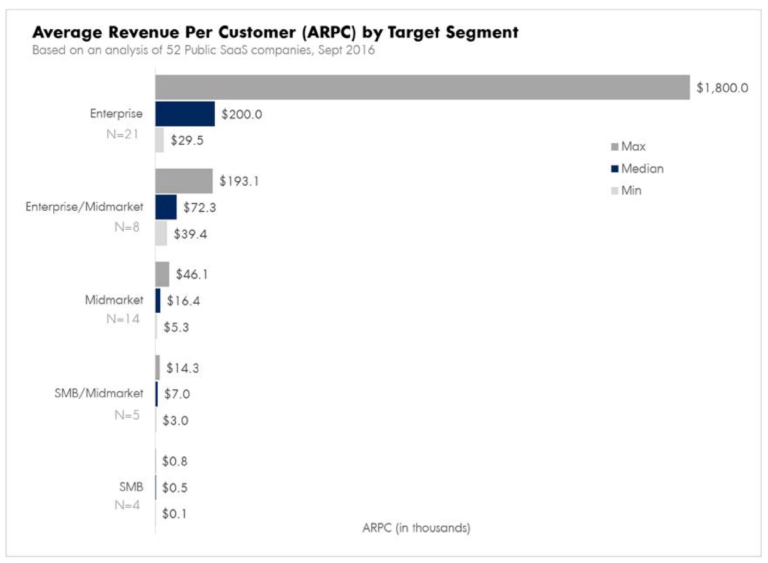

In their guide, OpenView analyzed statements of 52 publicly traded SaaS companies. In the infographic below you can see SaaS prices they were realizing. For each of the company, they collected several data.

Like:

- target segment(s),

- annual revenue,

- the number of paid customers,

- and annual average revenue per customer (ARPC).

Average Revenue Per Customer by Target Segment

At first glance, you can see that the most significant number of companies targets large Enterprises. They tend to have hundreds of customers, preferably from the Fortune 1000 list. Enterprise-focused companies go after a very thin slice of the market. But, they make up for it by commanding a median ARPC of $200,000.

Almost a quarter of companies target Mid-Market buyers. It can mean that the company only goes after the Midmarket or that their customers are evenly distributed from very small to very large. While their ARPC ranges from a low of $5,300 to a high of $46,100.

Only 4 out of 52 companies are SMB-focused. These companies, earn a median of $500 per year, of $40 per month from their customers. Maybe the solution for them is to chase a bigger market. They have a cost-efficient go-to-market model.

First midpoint – Competitive Analysis

Another thing for you to do is to find out your competitive landscape. To narrow price model range, you should conduct an in-depth competitive analysis. For many startups, there is no direct competition. So, you’ll have to watch companies you consider peers. How can you do this? There are numbers of ways:

- Gather information by online research.

- And, be sure to check out SaaS pricing model.

- Read their press interviews.

- Find software reviews services.

- Also, third-party research reports can be useful.

- Plenty of information you can find on forums or database services.

- Finally, don’t forget to read financial statements.

All this will help you familiarize with the environment you are in.

Second midpoint – Economic Value Analysis

Most noteworthy, you’ll need to answer a big question. How much economic value your product creates for customers? How much value do you think it creates? This typically consists of incremental revenue, reduced cost, reduced risk or time savings. For each, you can attach monetary value. Which pricing model you will choose depends on your target audience. The amount of captured economic value depends on your ability to prove a benefit. Also, how much that benefit matters to your target customer. And the consistency of financial value for customers. You will not be able to capture them all. In conclusion, pay attention that what is essential for one, is not necessarily relevant to others.

Ending point – Market Research

Finally, you need to get specific buyer feedback on their needs, values, and willingness-to-pay. There are two available SaaS pricing model market research types: qualitative and quantitative.

Qualitative method

Most common qualitative research in B2B markets is one on one interviews. They are doable when you have a small universe of target customers. While chats last up to 30 minutes each, they can cover a wide variety of topics. Interviews should be direct to the customer’s needs, not price.

The next stage is to apply the van Westendorp method. Interviewers are asked a series of open-ended questions. With the aim to find the right price for product or service. What is buyers “acceptable” price? When does it start to get too “expensive”?

In our first article about SaaS pricing, we’ve talked about Meetup company. If you remember, they applied qualitative SaaS pricing model techniques. It helped them to set the launch price for their new product, Meetup Pro. They talked with existing customers about possible features. What would be helpful to them? How did they use the product with their current groups so far? Finally, together the insights from this research led Meetup to a segmented pricing strategy. Because of that, they addressed companies willing to pay different sums. From large enterprises to startups and nonprofit organizations.

Quantitative method

When you are targeting a more significant number of potential customers quantitative research is your best choice because it provides you with statistically significant data. As a result, you can compare and contrast responses across different segments of participants.

First of all, keeps surveys on the shorter side, up to 15-20 minutes. This way you can influence the risk of survey fatigue and poor quality data. This will give you more opportunity to use indirect pricing methods, such as conjoint analysis, as well. You can show respondent’s sets of product configurations and price points. Furthermore, they can choose which they would be most likely to buy. Indirect research methods, like conjoint, are more reliable than qualitative methods allowing you to optimize pricing model and forecasting outcomes across a population. However, they need much more time, skill and expertise to conduct them which is why they rarely get applied in the start-up software world.

Having regular conversations? It allows you to have new data at your disposal. Use it to lower or raise pricing model from where you started. Even if you’ve launched your product, you can fix it. The good news is you still have time to collect extra data and improve your SaaS pricing over time. You should continuously test the data and change the price by them.

How x.ai successfully applied anti lean SaaS pricing model approach?

X.ai’s mission was to build an autonomous AI agent. In the beginning, they spent three years of intense R&D to apply the anti-lean approach, the term that Dennis R. Mortensen, company’s CEO, use. To follow through, x.ai had to raise significant funds to validate the idea and build the initial SaaS pricing model. For the sake of maintaining efforts, they had to be sure to find customers eager to pay for the product.

The company launched three levels of pricing. In charge of creating a pricing plan were Stefanie Syman and Brian Coulombe, VP of Customer Experience & Communications and Customer Acquisition Director.

As a result, this was their master plan:

Need to have a right mindset for the right price

Their mission was to democratize the personal assistant. What flowed out from this was the need for a price that’s digestible to the professional individual. “We see x.ai as a core piece of the technology infrastructure. In the same way that email is a core piece of that infrastructure,” Syman underlined. In conclusion–it is necessary for everyone!

Whether you’re a professional or someone who is entering the workforce it looks like, x.ai could be an essential tool for your work. “Thinking about the problem with that mindset. Knowing and believing that we’re changing norms, leads you to quickly understand where you need to land on price in terms of scale,” Syman says. Finally, the team was ready to deal with the issue of SaaS pricing model.

It’s all in the details

So, they build their ideal customer. To the specifics. Who that was, job titles, company size, location and, also, pain points. But, most importantly what does it take to get that someone to pay for the Professional edition. x.ai gained exposure through organic word of mouth and a formal referral program. This way they were able to reach to their first group of beta users.

The company also enjoyed good press. They focused on the creation of a “schedule Nirvana” for customers. The result led to beta user growth. “Growth has been driven by our existing customer base encouraging other folks in their network to sign up,” Coulombe explains.

Finally, they had one more in their favor. The product was easy to take across from the beginner to the professional level. Once the a starts using it, other departments and partners get wind of it. So, it was an excellent way to increase business.

Return On Investment

The key component of x.ai pricing strategy was delivering value. No one gets a personal assistant anymore. Among company’s most advanced clients where people with the most scheduling-related pain points. Besides, the mid-tier price point wasn’t a big deal for users. Because it ultimately delivered a considerable value.

As a result, they made a simple calculation showing customers how much time they would save using their product. It was a clear demonstration of ROI in their marketing. Presenting the loss of ten hours per month only on scheduling meetings was a clear sign for their users.

The team builds a long-term business vision. Trying to understand how different prices can relate to each other. “Our starting point was conveying that the core product utility is the same across all editions,” says Coulombe. Consequently, they start thinking about which users are interested in which features.

There is no perfect SaaS pricing model

The team learned they could only use data to make the best possible decision. But, SaaS pricing model is always a work in progress. By examining their target market, x.ai team was able to build pricing structure that delivers an undeniable value. Both to the customers and the company. This is not the end of developing their strategy. Furthermore, they will use new data to improve it.

Hope this was helpful to you. SaaS pricing model is demanding but necessary part of your work, if you want to succeed. You got guidance on how to do it. Now, you only need to apply it. It’s a piece of cake!

Share your experiences and challenges with developing SaaS pricing model in the comments section below.