Most startups consider pricing options when it’s time to get the product out to the market. However, SaaS pricing is a long and demanding process and if not determined in the right measure, all of your hard work had been in vain.

SaaS Pricing – How much can you charge the customer?

Determining prices in software industry is a tricky job. While it’s true that you have unlimited possibilities here, often that is not an advantage. Considering all those questions you need to answer beforehand, it’s challenging for every company, let alone startups.

How to form a price? What parameters to consider when you’re the only one in the market with such a product or a service? How to assess the value of work invested in the product/service? Read on, we will help you with all these and much more.

This article is inspired by the GrowthHackers interesting study about pricing: “The Ultimate SaaS Pricing Guide for Seed-Stage Companies” by OpenView’s Kyle Poyar.The study is written in great detail and will take you a lot of time to read. But, if you don’t have that much time at the moment we will lay out the most significant data from the study here.

The guide starts with one interesting information:

Public SaaS companies capture anywhere from $100 to $1.8M per year on average from their customers.

To form a good price for your product or a service do not rely solely on competition as it could have harmful consequences for your business. Keep in mind innovation should not end with your product and that the charging must be a part of your new approach. Research showed that over 1000 SaaS companies have had several problems in pricing determination. More than 400 of them were in the seed stage.

Statistics say that the most common mistakes in SaaS pricing are:

- SaaS Pricing at the end. Only best-in-class companies take pricing into consideration earlier. Others do it before product launching. That is the case with almost half of seed stage companies as well.

- CEO’s determines the cost. 55% of seed stage companies handled pricing on an ad hoc basis. In almost 82% of seed stage companies CEOs influenced pricing. In opposition to 70% of expansion stage and 48% of growth stage companies.

- Without research and testing prices. Companies spend so much time on product testing, but not on how much customers are willing to pay for it. More than 40% of seed stage companies have never tested or piloted their pricing. A similar number never conducted a market research.

- Low starting cost. The statistics are very cruel in this case. 54% of seed stage companies charge less than $5,000 per year for an average customer. Compared to only 30% of expansion and growth stage companies. There is 41% of them who take a value-based approach to pricing. One-third is just mimicking competitors. A quarter of them makes a decision relying on instincts. Finally, a handful of 7% is taking a cost-plus approach.

The best thing you can do, when you are a startup, is that you can fix everything, regardless of a bad start. You have more flexibility to rethink and experiment with fees and you can set an appropriate price at any time. Of course, the sooner the better.

“The Ultimate SaaS Pricing Guide for Seed-Stage Companies” introduced two thoughtful pricing approaches. Companies like x.ai and Meetup had great success and we’ll explore how did they do it?

What about charging by the user and freemium?

The results among public SaaS companies show that the fee per user option is still a dominant one. Almost half of all pricing is done this way and the big question is why is that so?

First of all, we all heard about it. Customers know what they are paying for. It’s predictable to budget and thus it comes as no surprise that 35-37% of the companies still use this metric. But is this the right billing method for your company? You need to find out now. Or, you can try to incorporate usage into your SaaS pricing.

What is the main advantage of a usage-based value metric?

It is better in reflecting a unique value perceived by customers for your specific product. Whatmore, it tracks well with a land-and-expand business model. This way new customers can start at an affordable price giving you an opportunity to win them over by allowing them to use the product. Let them realize they can no longer continue their life/work without your product or service. As their needs become more sophisticated they will pay more.

Good examples of these metrics highlighted in the guide are Wistia and Zuora.

The video marketing platform for business, Wistia, has different pricing packages. Package price depends on the number of video clips that you post on their platform. Hence the price isn’t same for those who have several videos and those with much larger numbers. The number of clips increases customer expenses.

It is the same few of the product Zuora is offering. Monika Saha, Zuora’s VP of Marketing, explains:

“We chose to price based on transaction volume 8 years ago. At the time we got a lot of pushback from the target market. Buyers used to pay for accounting and CRM software on a per-user basis.”

Think twice whether per user pricing is the best value metric for you. Will it impede your growth prospects? In an early stage of your growth is tremendous flexibility. You can experiment with different pricing structures. Basically, your pricing model could be as innovating as your product offer.

What about freemium?

In the world of software businesses it has become customary to get something for free. Forever, if possible. But, it can be risky to go out to the market like this, especially if you are a startup. SaaS startups are now under big pressure to generate paying customers. Free offer attracts too many people outside of target market and in most cases, they will never convert to paying customers. Free users can drain scarce resources and that’s not good at all.

Pacific Crest, in 2015 annual survey, asked SaaS operators how much of their company’s new ACV is driven by freemium leads. Only 9% derived greater than one-quarter of their new ACV from freemium. SaaS entrepreneurs need to be more creative when generating leads and new business. Sometimes old-school tactics can help.

Four Approaches to Neutralize a Failing Freemium Model

- Free trials can showcase premium features. When the trial expires they’re disabled. This creates a much stronger incentive for the user to convert to paid customer. About 30% SaaS operators said free trial leads drove greater than one-half of their company’s new ACV.

- Tailored, hyper-specific free products can be great to attract your target buyers. Without cannibalizing their paid offerings. Such as Logo API, one of Clearbit’s free products. It makes one of their 85 data points available for free.

- Product qualified lead (PQL) engines. It means to sell entry-level versions of a product to individuals or teams within larger enterprises. As part of a land-and-expand business model.

- Anti-lean startup approach. Some companies reversed the playbook and become “anti-lean” startups. Companies like x.ai first monetize and then go out to the market. It took them almost three years to get to market, but buyers were eager to pay for their unique product.

The Meetup Example for Building Demand

The story about Meetup is especially relevant example of how failure can lead to success. The most important thing is not to give up. Grab all the chances you can get!

What was their situation at the beginning?

“Meetup has been building local communities for thirteen years. The team here had experimented with a number of strategies. Including Meetup Everywhere, corporate Meetup sponsorships, and even branded perks and incentives, but nothing seemed to stick.”

says Brian Lafayette, Director of Strategy at Meetup.

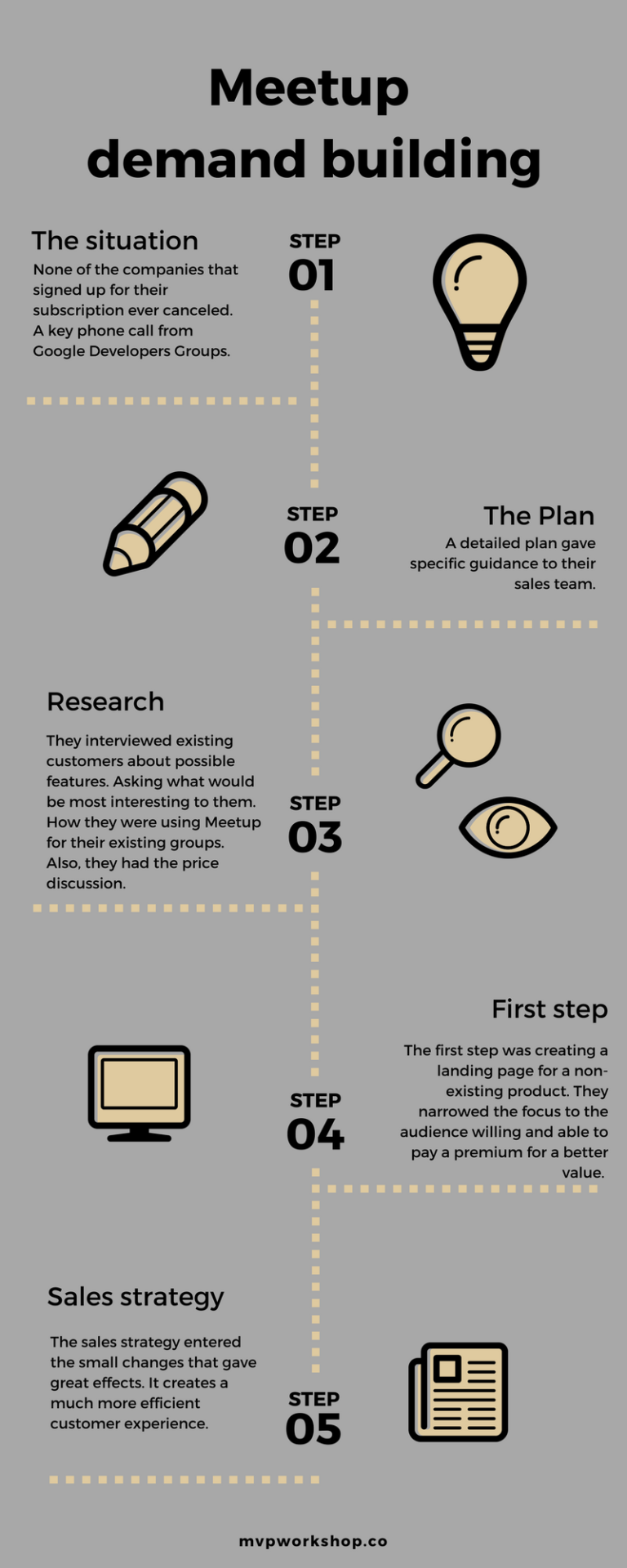

The situation

First of all, they had one encouraging fact. None of the companies that signed up for their modified subscription ever canceled. The catalyst for re-engagement was a phone call from Google Developers Groups. Their preference was to use Meetup to manage over 700 groups from all over the world. It seemed like it was going to be a turning point for Meetup.

Plan

The first thing was to come up with a detailed plan that would gave specific guidance to their sales team.

“The model also gave our sales team super-specific, month-by-month targets. It was easier for us to see exactly when they were falling short. So we could make proactive changes to improve conversion,” Lafayette explains.

Research

They investigated what went wrong before. The problem was long-distance group management. If what you build doesn’t leverage your core product, you will quickly lose support. The project was viewed as a distraction from the core business. Meetup’s core product has always been about facilitating and mobilizing local groups. So, this one served as an upgrade product in Pro Meetup. Once that was in place they interviewed existing customers about possible features they would like to see/have. They were asked what would be the most interesting addition to them and how were they using Meetup for their existing groups? Finally, they had the price discussion because it was crucial to understand the different price thresholds.

First step

The first step was creating a landing page for a non-existing product. They needed to confirm whether they could sell the product at the targeted price or not. So, the Meetup team took their offer to the market. They narrowed their focus to the audience that is willing and able to pay a premium option for a better value by creating a tried SaaS pricing structure that addressed three customer types: Big for-profit businesses, small for-profit businesses, and nonprofits for startups.

Sales strategy

The sales strategy changed providing a much more efficient customer experience. They featured Meetup Pro in the help section and began routing people who tried to add a fourth group directly to sales.A simple sign-up form with enabled credit card payments and removed comprehensive master service agreement was a deal maker.

“From there, it was just a matter of helping them see how easily they could upgrade to Pro. So they could manage their groups in a scalable way,” Lafayette says.

Future

As a result, 7 months after a Meetup Pro was launch, the user base has grown to more than 200 organizations and 5,000 paying groups. Amazingly product had 100% retention. They kept the original hacked solution ‘product’ as a kind of a backup option. In addition, it was one of the keys to retention rate. Customers who did not convert to the Pro version still had a product option at the platform.

At the end, I would like to announce the next part of this SaaS pricing blog post where we’ll introduce you a simple framework for pricing your new product. Stay tuned